Nvidia H200 chips cleared for China —

what the H200 is, what the U.S. decision actually says (dates and concrete conditions announced so far), why it matters commercially and strategically, major reactions, short/medium-term technical and policy implications, enforcement and risk vectors, and what to watch next. I’ve used major news outlets and Nvidia’s tech pages for facts; the most important claims are cited inline.

TL;DR (one paragraph)

In early December 2025 the U.S. signaled it will allow Nvidia to export its H200 (Enhanced Hopper) AI training GPUs to approved commercial customers in China, but only under explicit conditions: Commerce Department vetting of buyers/end-uses, a reported 25% levy/tax/fee on such transactions, and continuing limits on newer architectures (Blackwell/Rubin) and sensitive military end-uses. The move reverses parts of earlier export bans and is being presented as a calibrated compromise to preserve U.S. commercial leadership while protecting national security — but it has provoked intense debate in Washington, will change the economics of supplying AI compute to China, and creates both enforcement challenges and new incentives for China to accelerate domestic chip programs.

Reuters

+2

TechCrunch

+2

1) What is the H200? A short technical primer

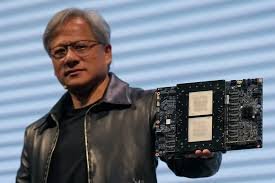

Product family & purpose: The H200 is NVIDIA’s “Enhanced Hopper” data-center GPU aimed at large-scale generative AI training and inference, positioned above the H100 as a memory-heavy, high-throughput accelerator for LLMs and HPC workloads.

NVIDIA

+1

Key hardware highlights: HBM3e memory (reported ~141 GB in mainstream spec sheets), very high memory bandwidth (several TB/s), and architecture optimizations (Transformer Engine, FP8/INT8 workflows) that boost throughput for very large models and long context windows. That extra memory bandwidth/size is precisely why it’s attractive for training very big LLMs.

NVIDIA

+1

2) What changed and when

Timeline / announcement: On 8–9 December 2025, multiple outlets reported that the U.S. — following a White House/administration decision announced publicly by President Trump and coordinated with Commerce Department action — will allow Nvidia to export H200 chips to approved customers in China, subject to national-security-oriented safeguards and a 25% fee. The Commerce Department was reported to be finalizing the implementation details at the time of the reporting.

Reuters

+2

TechCrunch

+2

Scope: The reports indicate the policy covers H200 class GPUs but not necessarily newer Blackwell-class (or other newer) chips, which remain more restricted. Final list and technical thresholds will be set in Commerce Department guidance.

Reuters

- Concrete conditions reported so far

These items come from press reports summarizing statements and early Commerce Department briefings; final rule text was not published at the time of those articles:

Buyer / end-use vetting: Only approved commercial customers in China may receive shipments — vetting to be done by the Commerce Department (export licenses and end-use screening). That implies background checks, end-user certificates, and possible ongoing monitoring/audits.

Reuters

+1

A 25% fee/levy on the transactions: Multiple outlets reported a 25% fee/levy to be collected by the U.S. on such sales (described variously as a tax, fee, or levy). The mechanics — whether collected at export, as a tariff, or by corporate remittance — and legal basis were being finalized.

Reuters

+1

Restrictions remain for more advanced chips: Newer families (e.g., Blackwell) and especially chips with capabilities beyond a defined threshold will remain banned or face far stricter controls.

Reuters

National security carve-outs: Military, intelligence, or other sensitive end-uses will be prohibited; the vetting is meant to stop items flowing to PLA or dual-use programs. Enforcement details were not public in full.

Reuters

Important: reporting at the time emphasized the Commerce Department was still finalizing implementing rules — watch the official Commerce/CBP/Federal Register guidance for the legal details.

TechCrunch

- Why H200 was singled out (policy logic)

Economic leverage vs security tradeoff: H200 GPUs are enormously valuable commercially; allowing controlled sales sustains Nvidia’s revenues, global supply chains, and U.S. influence over how advanced AI hardware is distributed — while attempting to reduce black-market diversion and maintain controls on state/military end-use. The 25% fee acts as both a revenue and deterrent mechanism.

Reuters

+1

Differentiation across chip generations: Keeping the very newest chips off the market (Blackwell) preserves a technical edge for the U.S. and partners while giving a managed channel for slightly older/high-value chips. This targeted approach tries to thread a needle between blanket bans (which push acquisition underground or accelerate domestic substitution) and unrestricted trade.

Reuters

5) Reactions: politics, industry and China

U.S. lawmakers: Many legislators reacted strongly. Some welcomed a pragmatic approach to preserve U.S. commercial leadership and jobs; others warned it risks enabling Chinese military modernization and urged reconsideration. Coverage quoted senators and other officials expressing both support and alarm.

The Guardian

+1

Nvidia: Publicly supportive; Nvidia’s leadership has lobbied for access to the China market and emphasized compliance and investment commitments. Nvidia stands to gain significant revenue if large Chinese cloud/service providers are allowed to buy H200s. (Nvidia’s product pages also stress the H200’s commercial importance.)

NVIDIA

+1

China: Initial reported reaction was positive/optimistic; Chinese cloud operators and AI firms that previously relied on H100/H200 access may welcome the change — though Chinese official rhetoric also emphasizes continued development of domestic chips.

The Indian Express

+1

- Economic and industry implications

For Nvidia: Potentially large incremental revenue (millions of dollars per rack) from renewed direct sales into China, though the 25% fee will shrink net margins and change pricing dynamics. The scale depends on which Chinese customers are approved (hyperscalers vs smaller firms).

REUTERS

+1

For Chinese cloud & AI firms: Access to H200 materially accelerates ability to train massive LLMs or scale inference economically — reducing model-training time and operational complexity relative to domestic alternatives. But the 25% fee and vetting add cost and friction.

WhiteFiber

For Taiwanese & global supply chain: Firms that manufacture packaging, memory (HBM3e) and systems for H200 remain central; partial reopening reduces pressure on alternative suppliers but also preserves incentives for China to keep investing indigenously.

NVIDIA

+1

7) Security, Diversion risk, and enforcement challenges

Smuggling and illicit diversion: Even with approved channels, smuggling and illicit re-export remain real risks; recent criminal cases allege attempted smuggling of Nvidia chips to China, underscoring enforcement gaps. Enforcement requires tight export license checks, supply-chain audits, and international cooperation.

Reuters

Technical enforcement limits: It’s hard to police on-the-ground model training vs benign research; chips can be used for dual-use purposes. Vetting buyers helps, but determined actors can obfuscate end-use or use intermediaries. The policy’s effectiveness depends heavily on thorough end-use auditing, secondary-market controls, and international cooperation.

Reuters

+1

8) Strategic implications – short & medium term

Short term: If implemented quickly, Chinese AI firms gain immediate performance gains for large models; Nvidia and U.S. supply chains recover some sales. The 25% fee acts as both a source of revenue and a possible chokepoint that raises the effective cost of compute in China.

Reuters

Medium term (1–3 years):

Incentive for domestic chips: Any controlled access reduces the urgency but not the desire for China to accelerate indigenous GPU/accelerator programs (e.g., companies like Biren, Cambrian, Phytium, and state-backed fabs). Many analysts expect domestic R&D to continue and accelerate, especially where access is still restricted.

Reuters

+1

Geopolitical signalling: The U.S. move signals a pragmatic, revenue-conscious posture that still seeks to limit the most advanced hardware. Allies will watch whether similar carve-outs are negotiated for their firms (AMD/Intel mentioned in reporting).

Reuters

9) Legal & practical questions still open: What to watch for

Exact legal instrument: Will the change be a Commerce Department rulemaking, a set of licensing guidelines, or an executive agreement? The legal form determines judicial review and transparency.

TechCrunch

How the 25% fee is implemented: Is it a tariff, excise, corporate remittance, or something else? Who collects it and how is it enforced/accounted?

Reuters

Approved customer list & thresholds: Which Chinese entities will be eligible (public clouds, private firms, research labs), and what technical thresholds (FP8 TOPS, memory size, interconnect bandwidth) define a permitted chip? Codified thresholds determine whether H200 variants are included. Reuters Monitoring & after-sale controls: Will the U.S. require firmware locks, remote telemetry, audits, or return conditions? Practical enforcement matters more than the headline permission. Reuters 10) Risks / counters to optimistic narratives Leverage vs leakage: Allowing sales increases U.S. financial leverage over distribution, but it also raises the risk of sensitive capabilities being indirectly transferred or repurposed. Many security experts warn that bake-in protections are rarely ironclad. The Guardian +1 Political backlash: The policy could face congressional scrutiny or legal challenges from those who argue it endangers national security. That introduces uncertainty for long-term commercial planning. The Guardian Chinese response: China might accelerate R&D on domestic accelerators and HBM memory to reduce reliance on U.S. chips — a self-help response that would shift the long-run competitive landscape. WhiteFiber 11) Bottom line — how big a deal is this? Commercially: Potentially large for Nvidia revenue and Chinese cloud/AI compute power — but the financial hit from a 25% fee and the friction of vetting will blunt rapid, unlimited adoption. Reuters +1 Strategically: This is a meaningful policy pivot: it shows a willingness to use controlled trade and financial mechanisms (fees, vetting) rather than absolute bans. It may slow some paths to Chinese military modernization while also softening economic harm. Whether it achieves the intended balance depends on the fine print and enforcement. Reuters +1 12) Quick reading list (sources I used) Reuters: “US to allow Nvidia to ship H200 chips to China, Trump says” (8–9 Dec 2025). Reuters +1 TechCrunch: “Department of Commerce may approve Nvidia H200 chip exports to China.” (8 Dec 2025). TechCrunch The Guardian reporting and commentary on reactions. The Guardian Nvidia H200 product page (technical specs / marketing). NVIDIA MobileWorldLive / industry press summaries. Mobile World Live Recent Reuters piece on chip smuggling prosecutions – example of enforcement risk. Reuters 13. What I would watch next actionable signals Official Commerce Department guidance or Federal Register posting (this will define the legal requirements). TechCrunch Nvidia investor statements / earnings call for concrete market expectations and whether they’ll accept the 25% fee or pass it to customers. TechCrunch Which Chinese firms are approved (cloud giants vs smaller players) — approval lists matter a lot. Reuters Congressional hearings / statements from key committees (Armed Services, Commerce) — possible legislative pushback. The Guardian Any follow-on measures by allies (UK/EU/Japan) — coordinated allied policy would change the enforcement landscape.