What the forecast says: 20.6 m units in 2025 — modest growth, accelerating momentum ????

According to the recent summary of IDC’s latest data, the global foldable smartphones shipment is expected to reach around 20.6 million units in 2025, which is an increase of about 10% over 2024.

AppleInsider

2+

techinsights.com

+2

This growth comes even as overall global smartphone shipments are projected to be relatively flat or only slightly up, reflecting a broader market recovering slowly.

IDC

+2

Reuters

+2

In other words, foldables remain a small slice of the total smartphone volume – but the slice is growing at a faster pace than the overall market, which shows increasing interest.

Gadgets 360

+2

techinsights.com

+2

Why 2025 — and especially 2026 — look important for foldables

Several factors combine to give foldables their likely boost now and soon:

New form factors and designs: More advanced foldable phones are introduced in 2025–2026, with not just traditional flips/folds but tri-fold/multi-fold variants attracting more “future phone” interest.

techinsights.com

+2

Omdia

+2

Entry/expansion by big brands: The entry of big players in foldables, such as the highly expected foldable version of Apple’s iPhone said to happen around 2026, could be a “game-changer” that will spur demand, according to industry trackers.

9to5Mac

+2

iclarified.com

+2

Continuous improvement and (gradually) lower prices: As hardware and manufacturing mature, foldables are becoming somewhat more accessible — not yet “cheap,” but better value for features.

Omdia

+2

Mordor Intelligence

+2

Premium-segment appeal: Foldables are often premium devices that come with higher price tags, but many see them as not just niche gadgets but aspirational “upgrade” picks for buyers moving up from mid-range or standard flagships.

Apple World Today

+2

Counterpoint Research

+2

As a result, many analysts are forecasting stronger growth for 2026 and beyond compared to 2025, with foldable shipments probably rising significantly YoY from the base in 2025.

9to5Mac

+2

techinsights.com

+2

Market Size, Value & Share: Folding remains niche but value is high

It is helpful to put 20.6 million units into perspective:

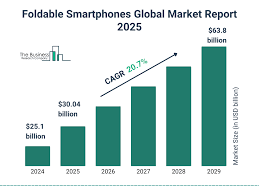

Another market-analysis firm, Mordor Intelligence, estimated that the overall market size of the foldable-smartphone segment was ~USD 31.3 billion in 2025 and will grow to ~USD 118.9 billion by 2030, at a CAGR of ~30.6%.

Mordor Intelligence

Despite growth, foldables are still a small fraction of total smartphones by volume. Projections suggest that foldables may remain under 3% of all smartphone shipments through 2029.

Gadgets 360

+2

iconnect007.com

+2

But since foldable devices tend to carry a much higher average selling price than standard smartphones, they tend to contribute disproportionately to revenue and market “value.” That makes them strategically important to manufacturers not only as a niche gadget but as a revenue driver for the premium segment.

Apple World Today

+1

Thus: foldables aren’t mass-market yet, but they’re becoming a high-margin, high-visibility segment for major smartphone makers.

Differentiation Based on Region-China, Rest of World, India

Growth in foldables isn’t uniform worldwide.

In large markets like China, foldable phones are gaining considerable traction. An estimate is that up to ~10 million foldable units in China might come out by end-2025.

TechNode

+1

Even as worldwide foldable shipments go up, in some local markets – for example, India – the demand remains tepid. As one report has it, sales of foldable phones in India dropped appreciably in 2024 by about 47%, and the first quarter of 2025 also saw a drop of about 20%. Experts there said foldables remain “for niche users” – citing device fragility, high cost, and impracticality for everyday use.

Times group of publications, Navbharat Times

+1

This mixed regional demand pattern suggests that, for global manufacturers, the foldable growth will likely emanate from those specific markets where premium-segment penetration is higher: China, the US, and parts of Europe, while foldables may remain aspirational in price-sensitive markets like India for some time.

Challenges & What’s Holding Foldables Back

Despite optimism, a number of headwinds remain-they explain why foldables are still not “mainstream”:

Higher cost: Foldables really are way pricier than regular smartphones, often 2–3x more. That makes them limited to premium buyers, whereas for many, traditional phones make more sense.

Navbharat Times

+2

Communications Today

+2

Durability, practicality & content ecosystem: Foldables often have a reputation for being fragile in nature- hinges and bendable displays, less pocket-friendly, and especially in their early years, a scarcity of content-apps, media, and more-optimized for the foldable form factors.

Navbharat Times

+2

Bangkok Post

+2

Slow Adoption Outside Premium Buyers: The outcome of these two factors is that foldables still interest only a small, niche audience in consumer purchase decisions. Broad adoption among mainstream buyers-that is, mid-range, mass-market buyers-remains far away.

Communications Today

+2

Gadgets 360

+2

Competition from other innovations: As advancements in generative AI, improvement in cameras/imaging, and more affordable 5G/AI-enabled phones occur, some consumers may favor a newer but conventional smartphone over a high-dollar foldable — especially if features other than form factor are what matters.

Gadgets 360

+2

techinsights.com

+2

???? What to Watch — What 2026 & Beyond Could Bring

Based on current trends and forecasts, here’s what to watch if you’re following the foldable-phone market:

Major launches from top brands: the entry of big players will mean foldables shift to more mainstream premium devices, perhaps even the launch of Apple’s foldable iPhone. That could change consumer interest and expectations. 9to5Mac +2 eu.36kr.com +2 Better designs, lower price thresholds: As manufacturing improves, as competition increases (with Samsung, Huawei, Motorola among many others), foldables may become a little less expensive and more resilient for an increasing audience. Omdia +2 Mordor Intelligence +2 Growth in key markets – like China, parts of Asia, North America, and Europe – where premium segment devices are more common – could see foldables become mainstream as the “second half” of the smartphone market. “Value” share shift, not necessarily volume share: Even if foldables remain a small share percentage by volume, they can be a growing share of smartphone revenue total. This would make them strategically important to the vendors. Apple World Today +1 Niche segmentation may see a potential uptake among professionals, technology enthusiasts, and frequent travelers or users in need of screen real estate for productivity, video editing, reading, and so on. My View / Interpretation: Foldables — A Gradual, Premium-First Adoption Curve Based on data and forecasts, here is how I see the ongoing journey of foldable smartphones: Foldables stay an early-adopter/premium-first product today — 20.6 million units is respectable growth, though then again, compared to ~1.2 billion total smartphone shipments, it’s still a sliver. The next 2–3 years will mark the tipping point, as with better designs and competitive pricing — and most likely an entry by Apple — foldables could move from niche curiosity to a steady premium segment. Not “mass cheap smartphone” — but “premium alternative and niche premium device” — Unless prices drop significantly and durability becomes stellar, foldables are unlikely to become mass-market devices comparable to mid-range smartphones. They will more likely remain a “luxury / premium” class, useful for a subset of users. Their real value may be in revenue and brand differentiation, not volume – For smartphone makers, foldables may not drive unit growth, but may help push up average selling prices, margins, and brand leadership.